Creating a budget and sticking to it is essential for financial stability and success. It helps you keep track of your spending and ensures that you’re not spending more than you earn. Here are five simple steps to create a budget and stick to it:

1. Calculate Your Income and Expenses

The first step in creating a budget is to calculate your income and expenses. Start by making a list of all your sources of income, including your salary, investments, and any other sources of income. Next, make a list of all your expenses, including bills, groceries, entertainment, and any other expenses you have

2. Determine Your Needs and Wants

Once you have a list of your income and expenses, you need to determine your needs and wants. Needs are things that are essential for your survival, such as food, housing, and utilities. Wants are things that you would like to have but are not essential, such as a new phone or a vacation.

3. Set Realistic Goals

Setting realistic goals is essential for creating a budget that you can stick to. Start by setting short-term goals, such as paying off a credit card or saving for a down payment on a house. Once you’ve achieved your short-term goals, you can move on to long-term goals, such as saving for retirement.

4. Track Your Spending

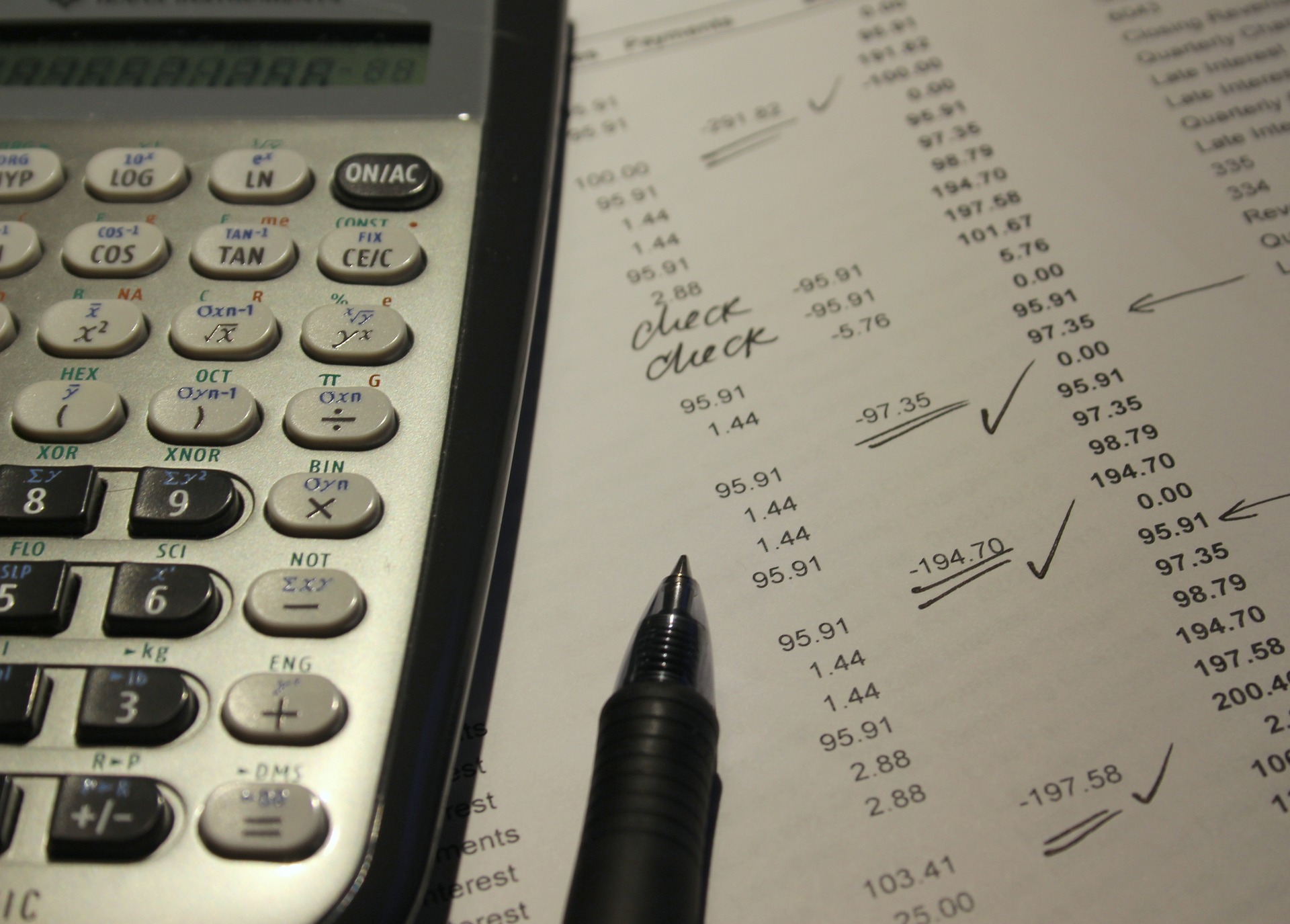

Tracking your spending is crucial for sticking to your budget. Keep track of all your expenses, including the small ones, and make sure they are within your budget. You can use a spreadsheet or an app to help you keep track of your spending.

5. Adjust Your Budget as Necessary

Finally, you need to adjust your budget as necessary. Life changes and your budget needs to change with it. If you get a raise or have a new expense, adjust your budget accordingly.

In conclusion, creating a budget and sticking to it is essential for financial stability and success. By following these five simple steps, you can create a budget that works for you and ensures that you’re not overspending.